Our Personal Loans Canada Ideas

Our Personal Loans Canada Ideas

Blog Article

The Buzz on Personal Loans Canada

Table of ContentsAll About Personal Loans CanadaThe 15-Second Trick For Personal Loans CanadaPersonal Loans Canada Fundamentals ExplainedThe Definitive Guide to Personal Loans CanadaSome Known Facts About Personal Loans Canada.

Doing a routine spending plan will give you the self-confidence you need to handle your money effectively. Excellent things come to those that wait.Yet saving up for the big things indicates you're not entering into financial debt for them. And you aren't paying extra in the long run as a result of all that interest. Count on us, you'll delight in that household cruise or play area collection for the children way a lot more recognizing it's already spent for (rather than making settlements on them until they're off to university).

Absolutely nothing beats peace of mind (without financial obligation of course)! You do not have to turn to individual car loans and financial obligation when things get tight. You can be complimentary of financial obligation and start making genuine traction with your money.

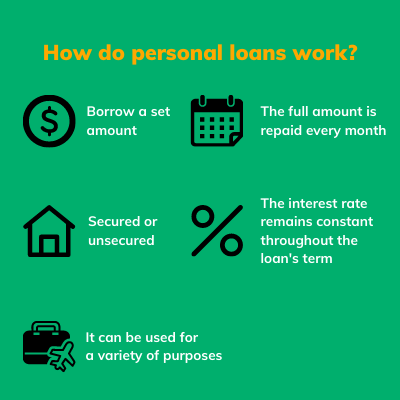

They can be safeguarded (where you provide security) or unprotected. At Springtime Financial, you can be accepted to obtain cash up to loan amounts of $35,000. A personal loan is not a credit line, as in, it is not rotating funding (Personal Loans Canada). When you're accepted for an individual lending, your lender offers you the complete amount all at when and afterwards, normally, within a month, you begin repayment.

Everything about Personal Loans Canada

A common reason is to combine and merge financial obligation and pay all of them off at the same time with a personal lending. Some banks placed specifications on what you can use the funds for, but many do not (they'll still ask on the application). home enhancement car loans and improvement lendings, lendings for relocating expenses, trip financings, wedding loans, medical lendings, cars and truck repair lendings, fundings for rental fee, little auto financings, funeral financings, or various other expense repayments in basic.

At Spring, you can apply no matter! The demand for personal financings is increasing amongst Canadians thinking about leaving the cycle of cash advance, settling their financial debt, and rebuilding their credit history. If you're making an application for a personal loan, here are some points you need to remember. Personal fundings have a set term, which means that you understand when the financial debt has to be repaid and just how much your repayment is each month.

Personal Loans Canada Fundamentals Explained

Furthermore, you could be able to minimize how much overall interest you pay, which means even more cash can be saved. Individual financings are powerful devices for constructing up your credit report. useful site Payment background make up 35% of your credit history, so the longer you make normal repayments on schedule the more you will see your rating rise.

Personal lendings supply an excellent chance for you to rebuild your credit report and repay financial debt, yet if you don't budget appropriately, you might dig on your own into an also much deeper opening. Missing one of your monthly repayments can have an unfavorable result on your credit report but missing out on Visit This Link numerous can be ruining.

Be prepared to make every single settlement in a timely manner. It holds true that a personal funding can be utilized for anything and it's much easier to obtain authorized than it ever before was in the past. However if you don't have an immediate need the added cash, it might not be the most effective remedy for you.

The repaired month-to-month settlement amount on an individual financing depends on just how much you're borrowing, the rate of interest, and the fixed term. Personal Loans Canada. Your rates of interest will depend on elements like your credit report and income. Most of the times, individual funding rates are a whole lot less than bank card, however sometimes they can be higher

All About Personal Loans Canada

Rewards include wonderful rate of interest prices, unbelievably quick processing and financing times & the anonymity you might want. Not everyone suches as walking right into a bank to ask for money, so if this is a difficult area for you, or you simply don't have time, looking at online loan providers like Spring is a fantastic option.

That greatly depends on your capability to pay this page off the amount & pros and disadvantages exist for both. Repayment lengths for personal car loans usually drop within 9, 12, 24, 36, 48, or 60 months. Sometimes longer settlement durations are an option, though uncommon. Shorter settlement times have very high monthly settlements but then it's over promptly and you do not lose even more money to passion.

Getting The Personal Loans Canada To Work

Your rate of interest can be linked to your repayment period as well. You might obtain a reduced rate of interest if you finance the financing over a shorter duration. An individual term funding includes an agreed upon payment schedule and a taken care of or drifting passion price. With a drifting rate of interest, the rate of interest amount you pay will rise and fall month to month based on market adjustments.

Report this page